By Antonio Garcia Feb 16, 2026 6 min

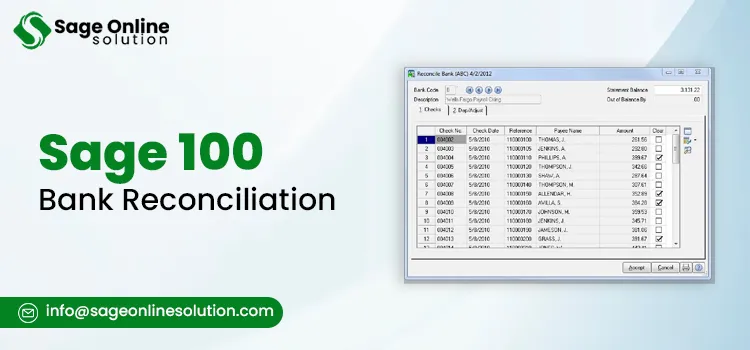

Now, no more tedious, time-consuming, and often frustrating manual bank reconciliation! Fortunately, we have the advanced Sage 100 ERP, which comprises specific modules, including Bank Reconciliation. Using Sage 100 bank reconciliation module, professionals can go beyond the basics and manage their month-end to-dos. From ensuring 100% accuracy to creating a seamless bridge between the bank statements and the General ledger, the module provides holistic perks of financial management.

In this post, we will learn about how to do bank reconciliation, what major perks you can avail yourself of, and much more.

Ask for professional supervision or an expert’s knowledge on Sage 100 bank reconciliation at +1-844-341-4437. Our experts are 24/7 available to assist and guide you further.

Table of Contents

ToggleAsking for Sage 100 bank reconciliation? Well, we can call it an Automated Bookkeeper that helps business professionals like you manage their cash accounts. Primarily, this module ensures that whatever financial data is reflected in Sage 100 General Ledger matches exactly with what’s happening in your actual bank accounts.

Want to ensure your General ledger remains accurate and fully synchronized with your bank records? If yes, reconciling your bank accounts in Sage 100 will make it. To learn how to do bank reconciliation in Sage 100 under the expert’s supervision, you can call +1-844-341-4437.

Before that, follow the prompts below to initiate the reconciliation process:

Step 1 – Setup Preparation

For accurate results in Sage 100, reconciliation must be done correctly. To make it possible, complete these essential preparatory steps before you begin:

Step 2 – Continue Accessing The Reconcile Module

Sage 100 bank reconciliation module is your financial integrity check, allowing you to keep your books accurate and your cash flow transparent. As discussed earlier, the module allows multiple bank accounts to be managed efficiently, handling specific transactions. To begin with:

Step 3 – Manually Enter Transactions

If any transactions haven’t been automatically posted even after integration, we suggest that you enter them manually. Do this on the check, deposit, and adjustment entry screen by following the prompts below:

Step 4 – Begin Sage 100 Bank Reconciliation

Once you perform all the above steps, start Sage 100 bank reconciliation. Call Sage at +1-844-341-4437 to reconcile accounts under the expert’s supervision:

Even you will agree that efficiency depends on two major factors, which are data integrity for accuracy and Sage automation features for speed. Thus, along with learning how to do bank reconciliation in Sage 100, it’s also crucial to ensure the reconciliation is accurate and efficient. For this, consider the best practices given below:

Before Reconciling Accounts

During The Bank Reconciliation

Post-Reconciliation Checklist

Sage 100 bank reconciliation module acts as a financial viewfinder, helping professionals manage their cash flow efficiently. While the Sage General Ledger module tells what you should have, the Bank Reconciliation module indicates what you actually have left to spend.

Below, we have listed the core functions of Sage 100 accounting software BR module:

Real-Time Visibility

The Bank Reconciliation module of Sage 100 connects your Book Balance, which is the total amount reflected in the software, with the Bank Balance.

Fraud Detection

Cash flow management is beyond just moving money and is also about protecting it. The Bank Reconciliation module serves as a front-line defence.

Accurate Forecasting

Sage 100 bank reconciliation maintains a real-time record of outstanding deposits and checks to ensure the modified cash balance. This amount helps distinguish what is available to spend from the actual totalities.

Automatic Minor Cash Management

Small, unlisted transactions can disrupt cash flow predictions. Fortunately, the module simplifies the entry of:

To learn more about how Sage 100 bank reconciliation improves your company’s cash-flow management, connect with our experts at +1-844-341-4437.

Don’t you think Sage 100 is more than just a digital check book? Well, yes! It’s a fully integrated ecosystem, which eliminates the cluster of information that happens while using spreadsheets along with the accounting software. Typically, it helps filter the data, which is reflected in Sage General Ledger and in your bank accounts.

Seamless Ecosystem Integration

Unlike standalone software services and tools, the Bank Reconciliation module is hard-wired into Sage 100 accounting.

Advantage Of Sage Bank Feeds

Sage 100 eliminates the manual “ticking and tying,” offering you the perks of:

Confident Audit Trails

When managing manually, deleting a mistake can leave a gap in your history. But, Sage 100 ensures integrity through:

Built-In Error Management

Sage 100 acts as a barrier for your data entry, helping you with:

Never overlook any minor issue while reconciling in Sage 100! To get the optimum results and efficient reconciliation, ensure you accurately perform at every step. For your assistance and professional help, our Sage experts are available 24/7. Connect with us at for quick Sage 100 Bank Reconciliation assistance.

Even with a robust system like Sage 100, facing errors or a few missed settings can lead to that frustrating moment where your difference just won’t hit zero. Below, we have listed the possible errors that you may encounter during or after Sage 100 bank reconciliation. Also, we have listed the relevant solutions, helping you fix these problems:

Unposted Transactions

It’s one of the major issues. If you printed checks in Accounts Payable or entered a deposit in Accounts Receivable but did not update the register, those transactions will not appear in the Bank Reconciliation module.

To fix it, always run your Daily Sales Reports and Check Registers before starting your reconciliation.

Posting Directly To The General Ledger

Sage 100 works best when data flows from sub-modules, including Accounts payable and Accounts receivable, into the General Ledger. But if someone enters a manual Journal Entry in the ledger to record a bank fee or wire transfer, and the balance changes, the Bank Reconciliation module doesn’t reflect that journal entry, creating a permanent discrepancy between the two.

To fix it, we use the Adjustments feature within the Bank Reconciliation module itself to record fees and interest. Also, you can ask for expert supervision on +1-844-341-4437 and learn how to perform bank reconciliation in Sage 100 without any discrepancies.

The Uncleared Checks Prior Month Transaction

Sometimes a check from six months ago finally gets cashed, or a stale check needs to be voided. Deleting or voiding a transaction in a prior, closed period can throw off your Beginning Balance for the current month.

You can fix it by never deleting a transaction that has already been part of a previous reconciliation. Moreover, use the proper Void procedures within the module to maintain the audit trail.

Date Mismatches

The Transaction and the Posting Date are not always the same in Sage. For instance, if you record a deposit on a specific date, but the system posts it on a different date. Eventually, when you run your reconciliation of that specific date, that deposit will be nowhere to be found.

Ensure you always verify the Posting Date when updating registers at month-end to avoid such issues.

Sage 100 bank reconciliation is more about just checking numbers, it’s about achieving total control over your company’s financial health. By transforming your from manual spreadsheets’ operations to Sage integrated automation, you’re not just saving time, but also inviting data integrity. Get ready to start scaling your business with confidence, and start by automating your first bank feed. Ask for professional supervision or an expert’s knowledge on Sage 100 bank reconciliation at +1-844-341-4437. Our experts are 24/7 available to assist and guide you further.

You May Also Read:

Frequently Asked Questions

Yes, but you must have the multi-currency module active. Sage 100 is capable of handling the conversion based on the exchange rate at the time of the transaction, but you will likely need to record a Gain/Loss adjustment during reconciliation to account for rate fluctuations.

Sage 100 reconciliation module helps you get an alert for unauthorized withdrawals or modified checks before they impact your accounts. Banks can occasionally make mistakes. From incorrectly encoded checks to double-posted fees, you may face blunders. However, the bank reconciliation module flags such discrepancies instantly, so you can claim your cash back.

The calculated total, including the starting cash balance of the reconciliation period of cleared transactions and the previous bank statement’s ending balance, is considered the beginning balance in Sage 100.

The common reconciliation adjustments in Sage 100 are deposits in transit, bank fees, outstanding checks, and the interest earned or charged by your financial institution.

You must connect with Sage 100 experts at +1-844-341-4437 for expert help while concluding bank reconciliation. Our team is available 24/7 to assist and guide you about all the dos and don’ts.

About The Author

Antonio Garcia

Antonio Garcia writes for Sage Online Solution and helps businesses manage their financial books more effectively. He offers practical advice and solutions that simplify accounting software use, so companies handle their finances with ease and accuracy. With years of experience, Antonio understands what businesses need to succeed. He aims to make accounting less stressful for everyone.

Feb 18, 2026

Feb 16, 2026

Feb 16, 2026

Feb 13, 2026

Feb 13, 2026

© Copyright 2026 Sage Online Solution | All Rights Reserved

For US Helpline +1-844-341-4437

For UK Helpline +44-800-810-1881